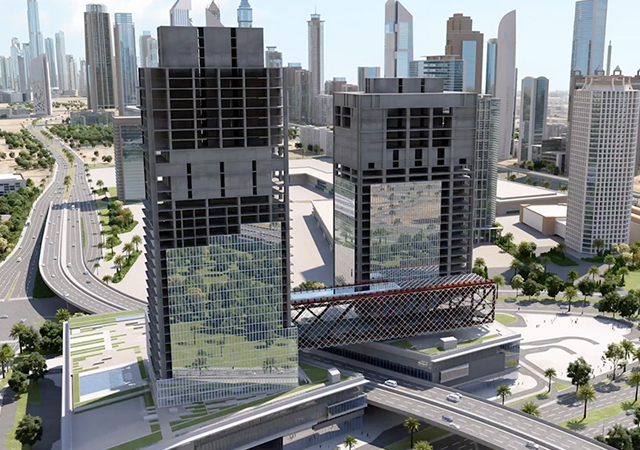

Idealist Real Estate, a Dubai-based luxury property company, has entered a strategic partnership with Citi Developers to integrate institutional-grade crypto payment technology into real estate transactions, through Xerime DMCC, reinforcing the emirate’s positioning as the most advanced regulated jurisdiction for virtual assets globally.

Xerime DMCC’s approach to real estate and digital assets is built on proprietary trading, where the company uses only its own capital, said a statement from the company.

This eliminates the need for client custody or third-party intermediaries, ensuring every transaction remains fully transparent and straightforward.

This marks the first real estate–crypto collaboration unveiled at Blockchain Life Forum which is aligned with the UAE’s national digital economy agenda, it stated.

The partnership arrives at a defining moment as global capital increasingly migrates from legacy jurisdictions toward markets offering regulatory clarity.

Citi Developers’ flagship project, Amra, will become the first luxury development in Umm Al Quwain engineered from inception to support instant.

According to the UAE Ministry of Economy, digital asset trading volumes in Dubai have exceeded AED2.5 trillion ($680 billion) since the beginning of this year, with over 1,000+ institutions licensed under VARA; making Dubai the world’s largest regulated virtual asset market.

"The UAE has the golden standard in real estate and my company truly integrates new technologies such as blockchain and crypto currencies and works only with licensed companies such as Xerime DMCC and Citi Developers who have years of trust. Idealist - is about ideal opportunities for clients to invest in the strong economy of UAE. We invest - in what we trust," remarked Alexey Gorbachev, the CEO & Founder of Idealist Real Estate and partner of Xerime DMCC, the crypto proprietary trading company powering the collaboration.

The collaboration introduces blockchain-enabled property transactions designed in line with Dubai’s regulatory standards, making Amra among the pioneering developments leveraging compliant digital asset settlement.

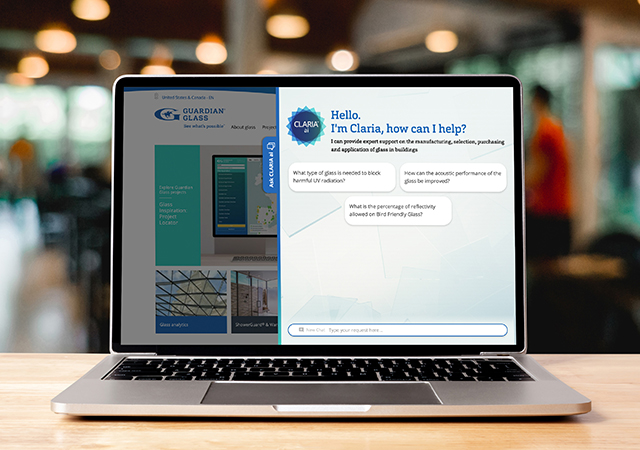

"What we are building is not a payment feature but a financial infrastructure," said Grigory Rybalchenko, CEO of Xerime DMCC.

"Global wealth is already moving on-chain, and Dubai is the first jurisdiction to create a truly regulated environment for it. With this collaboration, we are proving that real estate, the world’s most valuable asset class, can now be transacted with the same security, speed and transparency as digital finance," he added.-TradeArabia News Service

.jpg)

.jpg)

.jpg)