Abu Dhabi National Energy Company (TAQA), one of the largest listed integrated utility companies in Europe, the Middle East and Africa, has divested its 100% stake in TAQA Neyveli Power Company Private Limited to MEIL Energy Private Limited, an affiliate of Megha Engineering & Infrastructures Limited (MEIL), an India headquartered, large diversified conglomerate with strong business interests in infrastructure, energy and hi-tech manufacturing for a sale consideration of INR9.26 billion (approximately $104.65 million).

TAQA Neyveli owns and operates a 250 MW lignite-fired power plant located in the state of Tamil Nadu, India. As a result of this transaction, TAQA has fully exited its interest in TAQA Neyveli as the company sharpens its focus on low-carbon, highly flexible gas-fired power generation and, through its stake in Masdar, renewable energy investments.

Farid Al Awlaqi, Chief Executive Officer of TAQA’s Generation business, said: “This sale represents a considered adjustment to our generation portfolio as we continue progressing towards a more sustainable energy mix. It aligns with TAQA’s broader efforts to transition towards cleaner energy solutions, reduce long-term emissions, and respond to the changing dynamics of global energy demands. Our focus remains on developing flexible, efficient and low-carbon power generation assets that support sustainable growth and the energy transition.”

Over the past year, TAQA's Generation business has made several significant strategic growth investments as part of its long-term strategy to develop leading low-carbon power and water projects. In the UAE, TAQA recently unveiled plans for an additional 1 GW of gas-fired capacity, along with Masdar's 'round-the-clock' giga-project, which, upon completion, will become the largest integrated solar and battery energy storage system and will be capable of delivering 1 gigawatt (GW) of baseload renewable energy around the clock. Its subsidiary TAQA Morocco has announced it is exploring the acquisition of an existing Combined Cycle Gas Turbine (CCGT) power plant, as well as the development of new flexible, low-carbon gas-fired power and renewable power generation projects, seawater desalination projects, water transmission infrastructure, and electricity transmission infrastructure in Morocco.

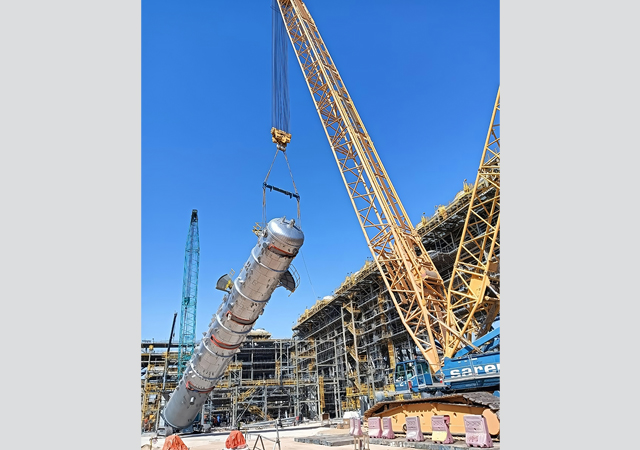

In Saudi Arabia, TAQA achieved financial close for the SATORP Cogeneration Plant and for two highly efficient gas-fired plants — the Rumah 2 and Al Nairyah 2 Power Plants, totaling approximately 3.6 GW. In 2020, TAQA had a gross capacity of 21GW, and today the company has grown to approximately 70 GW (as of 30 September 2025), as it sets out to achieve its 2030 target of 150 GW with two-thirds coming from renewables through its stake in Masdar.

TAQA’s clear focus is on investing in efficient, lower-emission technologies that support energy security, enable renewable energy integration, and address growing industrial demand. The divestment of TAQA Neyveli is consistent with this direction, allowing the company to focus on technologies that advance its 2030 Corporate Strategy for sustainable and profitable growth, the company said. - TradeArabia News Service

.jpg)

.jpg)

.jpg)