Dr Bakheet Al Katheeri

Dr Bakheet Al Katheeri

National Central Cooling Company, the world’s leading and most diversified district cooling company, today announced its results for the period ending 31 December 2025, reporting revenues of AED2.46 billion ($669.84 million) and net profit of AED465 million ($126.62 million).

The results reflect continued operational resilience, record capacity expansion and disciplined capital execution.

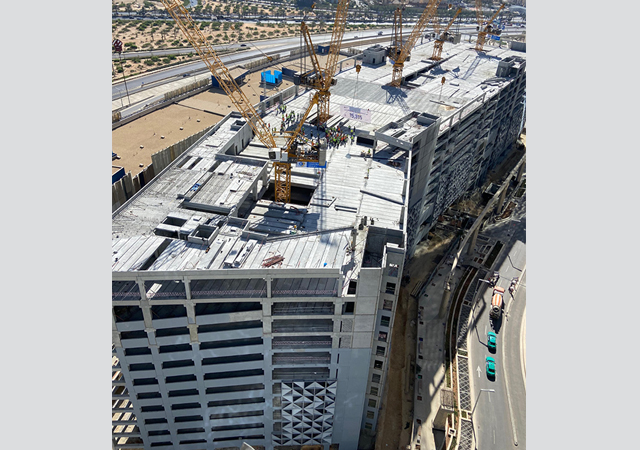

Total connected capacity increased 19% year-on-year to 1.57 million Refrigeration Tons (RT) as of 31 December 2025, driven by strong organic expansion and acquisitions. Excluding the impact of M&A, connected capacity growth was up 4.4% year-on-year, near the high end of the company’s guidance range. Organic additions reached 58,200 RT in 2025 — the highest level in the past five years — driven primarily by new connections in the UAE.

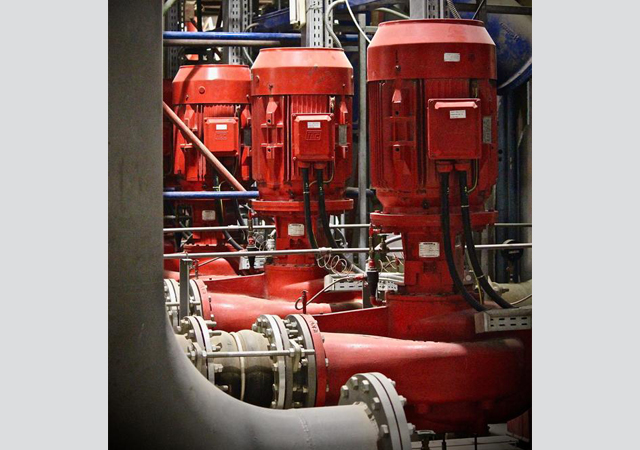

Inorganic additions totaled 190,800 RT, resulting from the PAL Cooling acquisition in a 50:50 joint venture alongside CVC DIF. Three new greenfield plants were commissioned during the year and five operational plants were acquired as part of PAL Cooling, bringing the group’s total to 99 operating plants. Consumption volumes reached 2.62 billion RTH, a slight 1% year-on-year decline due to relatively colder weather conditions. Throughout the year, operational availability and efficiency remained high, reflecting Tabreed’s investment in innovative technologies and proactive asset management.

Group revenue increased 1% year-on-year to AED2.46 billion, underscoring the resilience provided by fixed capacity charges despite weather-related softness in consumption revenue. EBITDA increased by 1% year-on-year to AED1.27 billion, with a margin of 51.6%, supported by operating leverage and efficiencies.

Net profit for FY 2025 was AED465 million, primarily reflecting the company’s continued operational strength while absorbing the impact of higher finance costs following the refinancing of low-cost debt at prevailing market rates and additional debt raised to fund Tabreed’s investment in PAL Cooling. Reported earnings also reflect one-off transaction costs related to the closing of the Palm Jebel Ali concession and PAL Cooling acquisition, as well as higher financing and fair value amoritisation charges related to the PAL Cooling JV.

Strategic milestones

- Completed the acquisition of PAL Cooling Holding in a 50/50 partnership with CVC DIF for an enterprise value of AED 4.1 billion, adding c. 600,000 RT of concession capacity across eight exclusive concessions on Abu Dhabi’s main island and Al Reem Island (ADGM).

- Signed a landmark joint venture and concession with Dubai Holding Investments to provide 250,000 RT of district cooling to Palm Jebel Ali. Construction commenced in Q3 2025, with first cooling expected in late 2027 or early 2028.

- Commissioned three new greenfield plants during 2025 and added five operating plants as part of the PAL Cooling acquisition, deepening Tabreed’s presence across core markets and reinforcing high operational availability

- In partnership with the UAE Ministry of Defence and Emerge, Tabreed completed the integration of around 4,000 solar panels supplying 2.4 MW of clean electricity to two Abu Dhabi district cooling plants. This reduces reliance on the grid during peak periods and prevents more than 2,600 tonnes of CO₂ annually

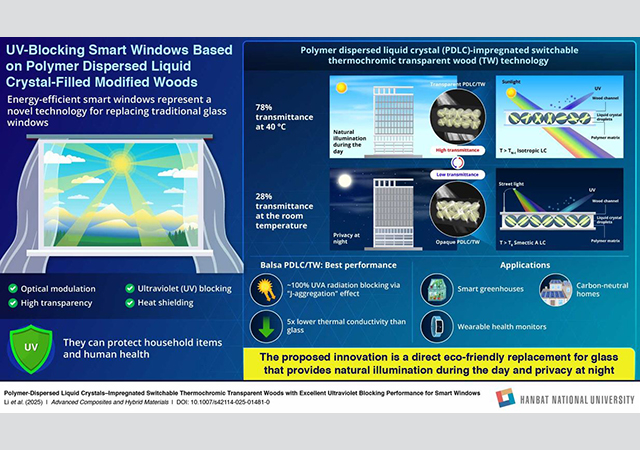

- Entered a long‑term framework with Johnson Controls to co‑develop next‑generation cooling technologies, including centrifugal chillers with variable‑speed drives and AI‑enabled performance analytics, supporting efficiency, reliability and regional climate‑neutrality goals

- Strengthened the capital structure and liquidity profile through refinancing of debt and additional debt issuance, thereby extending average loan maturity and supporting growth investments

Dr Bakheet Al Katheeri, Tabreed’s Chairman, said: “2025 was a transformational year for Tabreed, marked by major strategic steps that have strengthened our platform for both the medium and long term. The addition of PAL Cooling and the Palm Jebel Ali concession have deepened our presence in core markets and expanded the scale at which we operate. Across the business, our teams continued to deliver reliably for customers while investing in the systems and infrastructure that will support the company’s next phase of growth. As a national champion in district cooling, we are proud to support the UAE’s energy efficiency goals and remain focused on delivering capacity-led, concession-backed growth and creating lasting, sustainable value for our shareholders and stakeholders.”

Financial resilience

As of year-end 2025, net debt to EBITDA stood at 4.6x, a temporary increase in leverage reflecting the impact of PAL Cooling acquisition. Liquidity remains robust, supported by a fully undrawn AED1.2 billion Green RCF and the absence of any near‑term debt maturities. The company remains disciplined and focused in its capital allocation approach.

Tabreed strengthened its financial position during 2025 through the issuance of a $700 million Green Sukuk in Q1, executed under its Green Finance Framework, with proceeds directed toward refinancing of debt obligations. In Q3, the company doubled its Green Revolving Credit Facility to AED1.2 billion from AED600 million maintaining original terms. This increase materially improves Tabreed’s funding flexibility and underpins its broader creditworthiness. In Q4, the company raised AED1.8 billion new bank debt to support its strategic growth initiatives and optimise its capital structure.

Tabreed continues to hold investment-grade ratings from Moody’s and Fitch.

Dividend and outlook

The Board of Directors recommended a final dividend of 6.5 fils for H2 2025, bringing the total dividend for the year to 13 fils per share. This represents a payout ratio of 71% of 2025 normalised net profit, aligned with historical levels, despite significant investment undertaken to secure long-term growth.

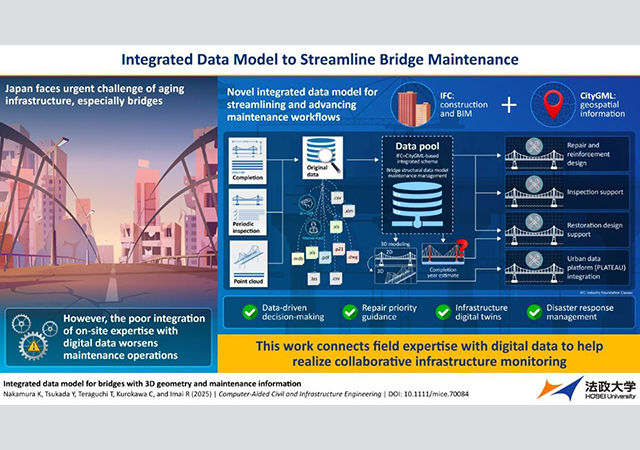

Tabreed enters 2026 with a strong and stable core business, supported by long-term contracted capacity, high operational availability and disciplined financial management. Capacity growth and margins are expected to remain within the company’s guided range, driven by continued real estate development, infrastructure expansion and delivery of new tourism destinations across the UAE and KSA. Demand fundamentals and customer relationships remain solid and the organic capex programme continues to progress on schedule.

Looking ahead, medium-term growth will be reinforced by the integration and ramp-up of PAL Cooling and the buildout of Palm Jebel Ali, both expected to contribute positively as capacity comes online. With a well-capitalised balance sheet and proven execution capability, Tabreed is well positioned to deliver sustainable, capacity-led growth through 2026 and beyond. - TradeArabia News Service